Gambling Tax South Africa 2017

The South African Revenue Service has been exploring the possibility of implementing a form of taxation on gambling winnings since the Minister of Finance’s Budget Speech in 2010.

Republic Of Gambia Lifts Gambling Ban

- REPUBLIC OF SOUTH AFRICA. IN THE HIGH COURT OF SOUTH AFRICA. GAUTENG DIVISION, JOHANNESBURG. Not of interest to other judges. In the matter between: SUNSHINE ENTERTAINMENT CC t/a First Applicant ‘ THE NEW MAROELA HOTEL’.

- May 30, 2017 The NGB can be contacted on 010 003 3475 and for any further information at www.ngb.org.za. Information relating to any suspected illegal gambling activity in South Africa can be provided to the NGB at fraudalert@ngb.org.za.

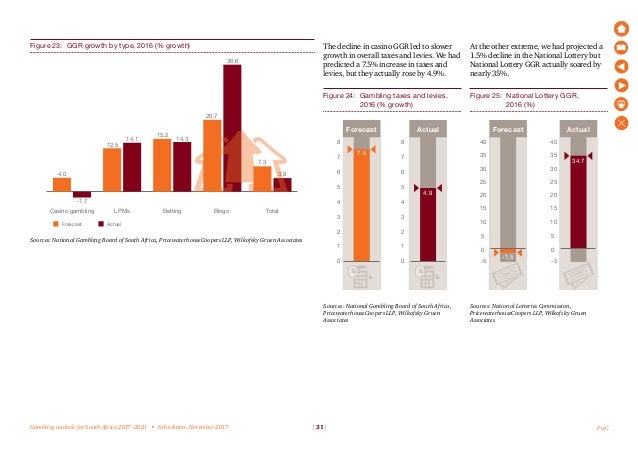

- Gambling outlook for South Africa 2017–2021 6th edition: November 2017 PwC Contents Photo courtesy of Tsogo Sun About this report 1 The gambling market: An overview 2 Gambling in South Africa 4 Gambling taxes and levies 8 Casino gambling 12 Limited payout machines 17 Bingo 20 Betting 23 National Lottery 28 Looking back: 2016 30 Conclusion 32.

- According to the Minister the proposed gambling tax would assist in discouraging excessive gambling in South Africa. In the 2013 Budget Speech, it was announced that a national tax based on gross gambling revenue of casinos would be introduced at a rate of 1 per cent in addition to the provincial rates.

As suddenly as it was decreed back in 2015

According to the Gambian press, President Adam Barrow has lifted a presidential decree banning gambling in the West African country.

Gambling, considered by former President Yahya Jammeh as ‘unethical and exploitative, was suddenly banned by Presidential decree in March 2015. The decree covered all forms of gambling including casinos, gaming centers and lotteries which were forced to immediately shut down.

According to JollofNews, the decision is part of the government’s strategy to transform Gambia into an attractive hub for investors and provide employment opportunities.

Kenya Parliament Dismisses Tax Hike (Update)

Reverts to 7.5 percent on gross profit rate

Kenyan Parliamentarians reversed a decision Tuesday, that would have raised betting taxes to a punitive 50 percent.

The decision approved late last week was revisited after majority leader of the National Assembly of Kenya, Aden Duale, invoked provisions of Standing Orders to return four sections of the Finance Bill, 2017 back to Parliament for a second vote.

Industry observers expected the rate would be negotiated down to around 35 percent in today’s Parliamentary session but were pleasantly surprised when the rate was returned to the 2016 level of 7.5 percent on gross profit. Casinos and other gaming companies will be taxed 12 percent, lotteries at five percent and prize competitions at 15 percent.

Parliamentary members reiterated the sector should be regulated but not through “counter-productive” taxation.

Gambling Tax South Africa 2017 Cricket

The Finance Bill 2017 now awaits Presidential signature.

South African Gamblers’ Winnings Confiscated

Gambling board warns, online gambling is illegal

The South African Government’s Department of Trade and Industry (DTI) sent a strong message to the public this week regarding illegal online gambling when it petitioned the Gauteng High Court to confiscate several online punters winnings following an investigation by the country’s National Gambling Board (NGB).

Despite online gambling being illegal in South Africa, a myriad of unlicensed operators offer their services in the country, seemingly with impunity.

The Court subsequently handed down an unprecedented ruling in which R1.25 million in winnings were confiscated and forfeited to the State.

“The public is hereby cautioned to be wary of online gambling offerings, as online gambling is illegal in South Africa and thus anyone participating in any illegal online gambling activity would be unable to receive any winnings and would expose themselves to criminal prosecution,” the Department of Trade and Industry cautioned in a statement.

The NGB collaborates with the banking fraternity in identifying illegal winnings as part of an anti-money laundering strategy. South African residents found to be gambling illegally are subject to the confiscation of their winnings and may face criminal charges or a hefty fine to a maximum of R10 million or both.

NGB accounting officer Caroline Kongwa appealed to the public to report websites advertising online gambling and establishments in South Africa, especially those disguised as internet cafes, offering online gambling and other illegal gambling activities to the public.

Economic recession in South Africa has helped to fuel a rise in the number of illegal gambling operators in the country.

Although the casino industry succeeded in growing its gambling revenue by 3.5 percent in the year to March 2018, that increase was still below the level of consumer inflation, so in real terms it represents a continuing contraction, following a poor 2017, in which gambling revenue shrank by 1.8 percent; the first contraction since the industry was set up in 1997.

And while illegal gambling operations continue to operate in South Africa, the general uncertainty over the regulatory framework for the industry is also having a negative impact on legal casinos, which currently employ around 38,000 people nationwide.

Tougher stance

Speaking about the rise of illegal gambling operations, the Chief Executive of the Casino Association Of South Africa (CASA) said that law enforcement agencies needed to take a tougher stance to tackle the unauthorized gambling market, which he said were effectively stealing from the nation:

One of our biggest concerns is the exponential growth of illegal gambling operations. These illegal operators pay no tax or levies and contribute nothing to the South African economy.”

According to CASA, the industry will pay around 37 percent of its revenue; a total of R6.1 billion, in levies and taxes, at local and national level, during the current tax year. According to a recent report by Pricewaterhousecoopers, the South African gaming industry is likely to grow at more than 5 percent per year and could be worth R35 billion by 2021.

Gambling Tax South Africa 2017 News

But CASA is warning that the government is denying the country substantial revenue by failing to crackdown on illegal operations, and through recently proposed changes to the casino industry, including a plan to introduce anti-smoking regulations in casino venues.

Gambling Tax South Africa 2017 Full Video

Andie Hughes is a UK-based freelance betting and gambling writer with over a decade of experience in the industry, having written for Betfair, ESPN, Boylesports, Sporting Life and various other popular betting sites. Contact Andie at andiehughes73@gmail.com.